How to use a brokerage account: how to sell and buy securities and currency

How to use a brokerage score. What can you buy for it. How to buy and sell securities and currency through a brokerage account. What is the commission when buying and selling.

Without Kevordo

Buy and sell securities and currency

Go through our short course – It is free and designed specifically for those who just enter the financial markets. The course will introduce you to the basics of investment, tell you how to avoid the most common mistakes of novice investors, how to protect money from inflation and collect your first diversified portfolio. Pass the course

Diversify – That is, do not invest all the money in only one asset, but put it on several tools. You can find different types of securities in the “Buy” section in the Tinkoff investment application and on the “Catalog” tab in the “Investment” section in your personal account on tinkoff.ru. And our robot-adviser will help you assemble a diversified portfolio. How the robot-advice from Tinkoff Investments works

Buy funds of funds – Instead of buying individual securities. This is one of the simplest investments for a novice investor. Managers of funds have extensive experience on the exchange, they themselves select and buy securities according to the stated strategy.

For example, Tinkoff Capital funds follow the “eternal portfolio” – this is a strategy based on a portfolio with the same shares of different types of assets, which should bring income regardless of the current state in financial markets. Promotions are growing in price during periods of economic growth, bonds – during economic stagnation, the currency stabilizes the portfolio during unrest, and the gold protects against inflation and even grows in price during crises. Buy share of funds Tinkoff Capital

- Ten currencies – euros, American and Hong Kong dollars, British pounds, Swiss francs, Japanese yen, Chinese yuan, Belarusian rubles, Kazakhstan tenge and Turkish lira;

- shares and bonds of Russian companies – on the Moscow Exchange;

- Exchange funds – ETF and BPIF;

- Eurobonds of Russian companies selling in dollars or euros – on Moscow and exchanges;

- shares of foreign companies from foreign exchanges NYSE, NASDAQ and LSE – on the exchange;

- Precious metals – gold and silver.

If you are interested in other securities – for example, shares of Brazilian companies or American Vanguard funds, go to the premium tariff: with it you can get the status of a qualified investor and trade papers from around the world. Read more about the Premium tariff

1. Log in – In the Tinkoff investment or in your personal account on Tinkoff.ru. To do this, you should open a brokerage account, you will not be able to buy papers without it. Open a brokerage account in Tinkoff Investments

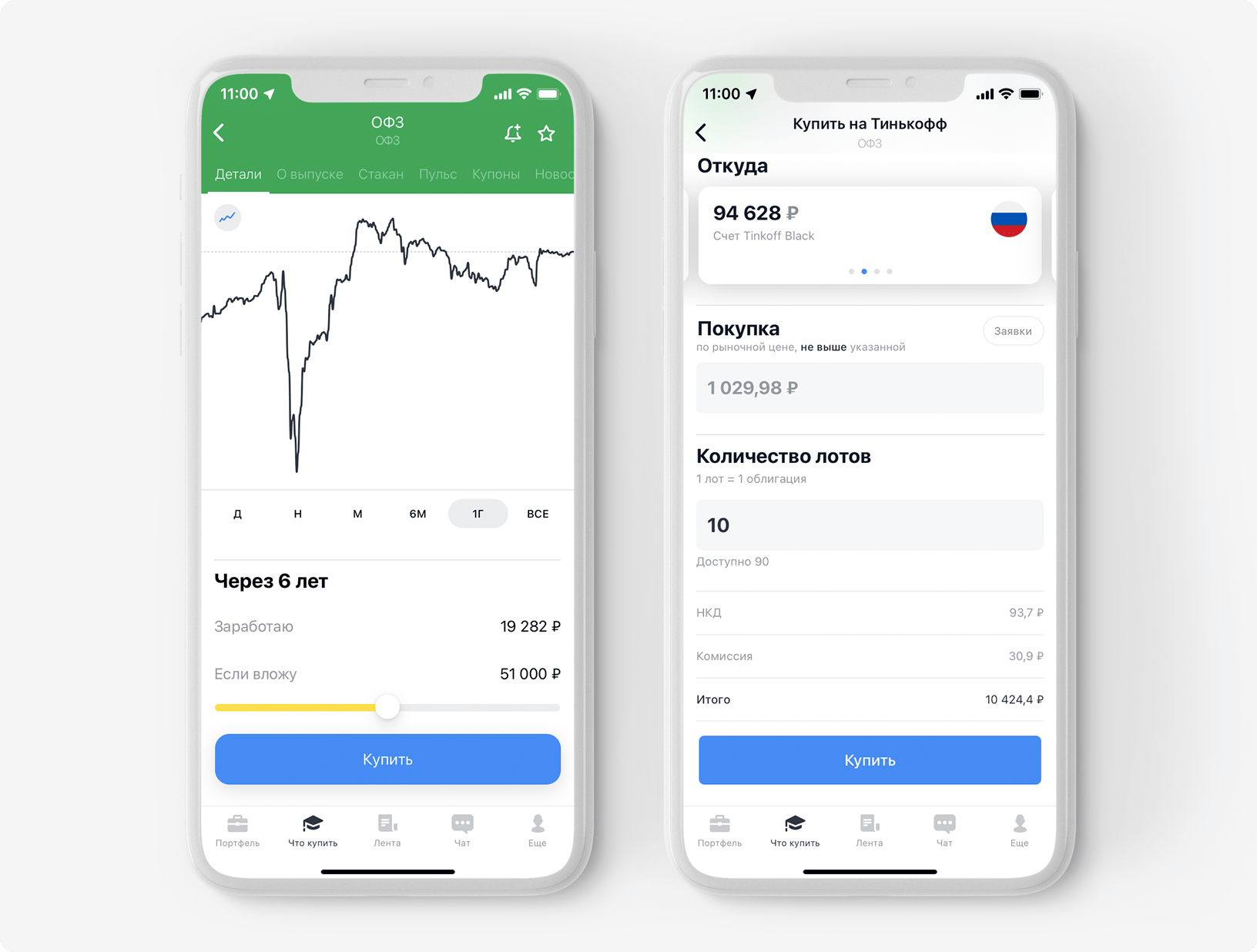

2. Select an asset for purchase – these can be stocks, currencies, bonds or fund units from the What to buy section in the Tinkoff Investments application or from the catalog on the tinkoff.ru website. View Tinkoff Investment catalog

3. Select the source of purchase — you can buy an asset in Tinkoff Investments from a brokerage account or directly from a Tinkoff Black card or a card from another bank.

4. Specify the number of lots – this is the name of the minimum amount of an asset that can be bought or sold on the exchange. Usually shares are traded in large lots: 10, 100 or even 1000 shares in one lot. For bonds and ETFs, one lot equals one security. You can buy currency from some brokers only in large lots – from 1000 units. In Tinkoff Investments, you can buy and sell currency from 1 unit, for example, one dollar or euro. You cannot buy less than one lot.

5. Click on the Buy button to confirm the purchase. It is impossible to fix the price on the exchange, therefore, until you click on the “Buy” or “Sell” button, the order will not go to the exchange and may be canceled. If you have enabled confirmation of transactions with a code, the application will not be sent to the exchange until you enter the code from SMS. After confirming the transaction, it will be executed, and you will be charged a commission according to the tariff. What are the fees on a brokerage account?

To buy securities in the Tinkoff Investments app, simply select the asset you like in the list, specify the desired amount and click Buy

Before buying or selling assets on the stock exchange, you will need to log in to the Tinkoff Investments application or to your personal account on the tinkoff.ru website – this way you will see the most up-to-date price. Without authorization, the price is displayed with a delay, so it may differ from other sources, such as Google Finance or investing.com.

After authorization, the security or currency page will display its market value for buying or selling. When you click the Buy or Sell button, we will display an order at the best price – typically 0.3% higher than the best offer or bid on the exchange. This is necessary so as not to cancel the deal even with the slightest fluctuations: on the stock exchange, the price of assets can change very quickly, even within a few seconds. If the price of the securities you have chosen remains the same or decreases, we will debit your account for an amount less than what was shown on the purchase page.

If the current price of the paper does not suit you, you can leave a special exchange order – this is an indication to the broker at what price you want to buy the paper. When the price on the exchange reaches this indicator, the broker will automatically execute your order and buy the securities. More about types of exchange orders

Sometimes the broker will not fully fill your order to buy shares at the best price: this happens when you want to buy more shares than what is offered in the market at the price you want, or if the price changes while you are buying securities.In this case, we will buy for you as many securities as will be sold on the stock exchange at the lowest price plus 0.3% to it.

For example, you want to buy 100 shares of Sberbank at 250 rubles, but at the moment only 20 shares are ready to sell on the stock exchange at this price. In this case, the broker will partially execute your order – that is, it will buy only 20 of these shares. If you want to buy the remaining 80, you will need to repeat the purchase operation again.

You can trade securities and currencies only during the opening hours of the exchange – each exchange has its own. In addition, during the calendar year, each exchange may have additional non-working days – usually on national holidays.

Due to the current situation, the time of trading for certain sections of the Moscow Exchange and the Exchange may be changed. We monitor messages from representatives of these trading platforms and promptly inform customers in ours.

Moscow Exchange — there you can trade currencies, precious metals, Russian securities and Eurobonds, Moscow time:

- currency and precious metals can be bought or sold from 07:00 to 23:49;

- Russian securities can be bought or sold from 06:50 to 18:44, but some securities are also traded in the evening – from 19:00 to 23:49;

- Eurobonds can be bought or sold from 07:00 to 18:39.

exchange — there you can trade foreign shares and Eurobonds of Russian companies, Moscow time:

- foreign shares can be bought or sold from 10:00 to 01:45 the next day. Some stocks are also traded in the morning from 7:00 am to 10:00 am. The main trading session with the largest trading volume lasts from 15:30 to 00:00;

- Eurobonds can be bought or sold from 10:00 to 18:39;

- TCS shares and other securities from the LSE exchange can be bought or sold from 10:00 to 19:35.

There are a little more holidays on the exchange, because it gives access to securities traded on foreign exchanges. Her days off depend on the public holidays of the countries in which they are located. In 2022, the weekend schedule is as follows:

- stocks from the American stock exchanges NYSE and NASDAQ — not traded on January 17, February 21, April 15, May 30, June 20, July 4, September 5, November 24 and December 26;

- shares of issuers from Germany — are not traded on April 15 and 18, and also on December 26;

- stocks on the LSE — not traded on January 3, April 15 and 18, May 2, June 2 and 3, August 29, December 26 and 27.

Some securities in Tinkoff Investments can be bought and sold, including on weekends. This allows you not to wait for Monday and make transactions with the necessary papers, even when the exchanges are closed. Orders are executed in the over-the-counter market between buyers and sellers, and the broker acts as an intermediary.

You don’t have to specifically connect and configure anything: just open the Tinkoff Investments application, select the securities available for trading on the weekend and complete the operation – the commission for the transaction is also standard.

Restrictions — trading on weekends is possible only on a brokerage account, they are not available for clients with IIS.Weekend trading is available in the mobile app and the Tinkoff Investments trading terminal. The ability to make transactions in your personal account on tinkoff.ru will appear a little later.

Trading time — on weekends you can trade from 10 am to 9 pm. Trading hours may be extended in the future. At the same time, pauses and stops in trading are possible in cases of increased volatility, news releases, lack of offers from counterparties and other factors.

Available papers – at the moment, Tinkoff clients will be able to trade some of the most liquid securities from the St. Petersburg Stock Exchange over the weekend. The exact list of available securities can be viewed in the Tinkoff Investments app, in the “What to buy” → “Weekend trading” section.

Schedule prices — during trading on a weekend, it is available only in the context of five minutes to one day. On the weekly and monthly charts, there will be no data on deals on weekends.

Transactions with securities on weekends are carried out at indicative quotes – that is, prices at which the broker's counterparties in the over-the-counter market are ready to buy or sell an asset.

In terms of reliability, transactions at such quotes do not differ from ordinary transactions on the stock exchange: you buy and sell real securities, and after the transaction, information will appear in the broker’s reports and in the depository, taking into account the trading mode.

Margin trading – this service is also available for weekend trading, but there are two important features:

- parameters for a liquid portfolio will be calculated based on the prices of the last trading day on the stock exchange;

- if there is a risk of a margin call, the forced closing of a position is possible only on the next trading day after the weekend. Learn more about margin trading

Types of orders, stop loss and take profit — when trading on weekends, you can only place orders of the Best Price type, that is, orders to buy or sell assets at the best price available at the moment. Limit orders, as well as take profits and stop losses are not available on weekends. What are stock orders

If you previously set a stop loss or take profit, they will not be executed on the weekend, even if the indicative price matches the conditions of the stop order.

Dividends – Weekend trades do not affect a stock's dividend cutoff date. For example, if Friday is listed as the last day to buy dividends on a security's page, you won't be able to receive them if you buy the stock on Saturday or Sunday. This is because weekend trades are processed on the same business day as if you had bought the shares on Monday.

Yes, you will be able to buy securities traded in dollars or euros directly from your Tinkoff Black ruble debit card. In this case, we will replenish the brokerage account with rubles from your card and automatically convert them into dollars at the current exchange rate of the bank.The most favorable rate is from 10:00 to 18:30 Moscow time – it is about 0.5% higher than the exchange rate.

In addition, you can fund your brokerage account immediately in foreign currency – for example, if you have cash dollars or euros. To do this, open an additional currency account for your Tinkoff Black card – it's free and takes no more than a minute. How to add an account in currency for a card

You can top up your card's foreign currency account with cash dollars or euros at Tinkoff ATMs that work with foreign currency – they are installed throughout Russia. Find the nearest currency ATM

After that, you just have to replenish your brokerage account from the currency account of the Tinkoff Black card and buy the foreign securities you like without additional conversion.

Just do not forget to switch the card back to a ruble account after buying foreign securities. How to switch between card currencies

The process is similar to buying them: you need to log in to the Tinkoff Investments application or in your personal account on tinkoff.ru, select the desired asset and click on the Sell button on its page. The money from the sale will instantly go to your brokerage account. How to buy securities on a brokerage account

Initially, you will be asked to sell the asset at the market price – this is the highest price at the moment. But if it does not suit you, you can leave an exchange order – this is an instruction to the broker to sell the paper when it reaches the value specified in the application. More about types of exchange orders

The commission for the sale of securities or currencies in a brokerage account will be similar to the commission for their purchase.

At the Investor tariff, the commission for transactions with currency and securities is 0.3% of the amount. Commission for transactions with precious metals – 1.9%.

For example, you bought Sberbank shares for 10,000 rubles. The transaction fee will be: 10,000 ₽ × 0.3% = 30 ₽.

On the Trader tariff, the commission for transactions with currency and securities is 0.04% of the amount. Commission for transactions with precious metals – 1.5%.

For example, in the morning you bought Gazprom shares for 100,000 rubles. The transaction fee will be: 100,000 ₽ × 0.04% = 40 ₽.

With the Tinkoff Investments Premium service, the commission for transactions with shares and currencies from the Tinkoff Investments base catalog is always 0.025% of the amount. For transactions with over-the-counter securities, the commission for a transaction is different – from 0.25 to 4%, depending on the specific asset. Transactions with precious metals are executed with a commission of 0.9%

In addition to the transaction fee, on the Trader tariff and in the Tinkoff Investments Premium service, you will be charged an account maintenance fee – if this is your first transaction for the billing period. Which tariff to choose

To do this, you need to sell your securities or currency. After that, the brokerage account will receive money from the sale of assets – it is they who will become the real financial result from your operations on the stock exchange.

As long as you own assets, their market value is constantly changing, so the broker only shows your hypothetical profit or loss – they are also called “paper”.

That is, even if the shares have risen in price by 50%, this is still not your profit.Likewise, a -20% loss won't become real until you sell the stock and lock it in.

A discrete auction is a special trading mode that the Moscow Exchange uses to stabilize the situation in the event of a sharp increase or decrease in the value of individual securities or the entire stock index.

- for all shares and depository receipts, if the Moscow Exchange index has increased or decreased by more than 15% relative to the values of the previous trading day;

- for individual shares and depository receipts, if their price has increased or decreased by more than 20% relative to the price of the previous trading day.

During a discrete auction, market orders cannot be placed – only limit orders with a specific price are available. The discrete auction lasts half an hour and consists of three series of ten minutes each. Based on the results of each series, the exchange determines the fair price of the auction based on submitted bids and concludes deals. Even if your order does not fill (for example, if your buy price is below the auction price or your sell price is above the auction price), it will remain active until the end of the current trading day.

Opening and closing auctions are special modes on the Moscow Exchange that help determine fair prices for shares at the start or end of trading.

Opening auction – minimizes the likelihood of manipulating the price of the first transaction at the very beginning of trading. For example, if the Moscow Exchange just launched the main auction, then the participants with the first bids could receive some advantages, since it is their bids that would determine supply and demand.

During the opening auction, bids from bidders for the purchase and sale of securities are collected – usually this happens 10 minutes before the start of the main auction. Then the exchange calculates the total demand and the total supply and, based on certain algorithms, sets the starting market price.

During the opening auction, both market and limit orders can be placed. Deals on bids placed in the opening auction are not concluded immediately, but after the end of the opening auction. Limit orders not executed during the opening auction are transferred to the main trading mode.

Closing auction — designed to determine the fair closing price of the auction. Funds are then guided by this price, which calculate the value of their assets from it, and this price will also be recognized as the official closing price. It is also used in calculating the values of stock indices and the value of assets within exchange-traded funds. The closing auction protects investors from possible manipulation when the latest bid can suddenly change the price of a security.

The closing auction is divided into 2 phases of 5 minutes each and takes place in the last 10 minutes after the end of the main session. Market and limit orders can be placed during the order collection phase (an order “at the best price” cannot be placed).Once the closing auction price is determined, only limit orders can be placed and only at the closing auction price.